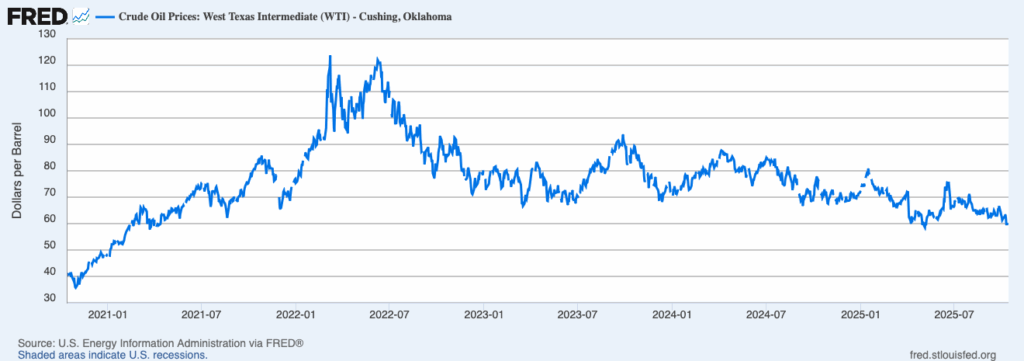

WTI crude oil price surged 3% Monday, pushing crude oil futures to $62.52 per barrel even as prices dropped 13% this year. Crude oil futures play a crucial role in price discovery and shaping market expectations. WTI crude oil futures are primarily traded on the York Mercantile Exchange, which serves as a key platform for price discovery and risk management in the oil market. Invest With Domestic Operating. The sort of thing I love about this recent jump is how it defies the persistent downward pressure from higher supply and weaker demand expectations. This price movement highlights the dynamics within the broader crude oil market, which involves a complex structure of producers, refiners, traders, and regulators.

OPEC+ plans to boost production by 411,000 barrels daily in July, but supplies remain tight. This third straight monthly increase at the same rate has only brought back 1.2 million of the 2.2 million barrels per day they cut earlier. The U.S. rig count has fallen every week in May and hit its lowest point since 2021, which definitely adds to the global supply squeeze. Supply disruptions—such as geopolitical conflicts or infrastructure outages—can further tighten markets and lead to sharp price movements. WTI price movements are closely watched across global commodity markets, as these markets are highly interconnected and shifts in oil prices can impact a wide range of sectors. Goldman Sachs expects a surplus of 1 million barrels daily this year. Many analysts believe declining U.S. production ended up pushing prices higher, which could signal a key shift in oil markets.

Introduction to the Oil Market

The oil market stands at the heart of the global economy, shaping everything from transportation costs to the price of everyday goods. Crude oil prices are influenced by a complex web of factors, including global supply and demand, economic growth, and geopolitical developments. This dynamic environment means that oil prices can experience significant price fluctuations, often in response to shifts in production levels, political tensions, or changes in consumption patterns.

For market participants—ranging from oil producers and refiners to investors and policymakers—understanding the oil market is essential. The balance between supply and demand is constantly shifting, impacted by decisions from major oil producers, technological advancements, and the broader health of the global economy. Geopolitical events, such as conflicts in key producing regions or changes in trade policy, can quickly alter the outlook for crude oil prices and disrupt the global supply chain.

Because of its central role, the oil market acts as a barometer for economic growth and stability. When oil prices rise or fall sharply, the effects ripple through financial markets and can influence everything from inflation rates to consumer spending. As a result, keeping a close eye on the factors that drive oil pricing is crucial for anyone involved in the energy sector or the broader global economy.

WTI crude oil price jumps 3% amid tightening global supply

Image Source: LinkedIn

Oil markets made a big comeback Monday as prices shot up. This surge happened because global supply got tighter and market expectations for future supply and demand played a key role, with markets expecting higher demand from key regions.

Live WTI crude oil price in dollar surges to $62.52

West Texas Intermediate (WTI) crude oil futures shot up $1.73, a 2.85% increase, reaching $62.52 per barrel [[1]](LINK 2). This resilient price movement shows a remarkable recovery after WTI crude oil futures hit four-year lows earlier this month. Prices bounced back after dropping about $10 per barrel through April and early May [[2]](LINK 3).

The recovery happened for several reasons. Market players saw promising signs from Europe and China’s demand [[1]](LINK 4). The U.S. also cut back on production, which squeezed supply even more. Both WTI and Brent showed a strong technical rebound as they climbed out of oversold territory [[1]](LINK 5).

Oil prices stay volatile because supply and demand don’t react quickly to price changes in the short term [[3]](LINK 6). So even small changes in what markets expect can make prices jump or fall sharply.

Price formation in the oil market is shaped by both spot and futures trading, with WTI crude oil futures serving as a key benchmark for price discovery and influencing global price dynamics.

Recent events have pushed up the “risk premium” in crude oil pricing. Prices usually climb higher than normal supply and demand would suggest when people worry about disruptions and there isn’t enough spare capacity or inventory to make up for possible supply losses [[3]](LINK 7).

Several U.S. energy companies, including Diamondback Energy and Coterra Energy, said they would cut back on drilling [[1]](LINK 8). These decisions ended up supporting higher prices by limiting future output.

Brent crude oil price also sees nearly 3% gain

Brent crude, the global benchmark, matched WTI’s performance with a $1.85 gain, jumping 2.95% to $64.63 per barrel [[1]](LINK 2). This shows how global oil markets connect – different crude grades’ prices usually move together, even though they keep some price differences between them [[3]](LINK 3). The integration of the global energy market means that price movements in one region can quickly influence prices in other regions, reflecting the interconnected nature of oil and refined product markets. Heating oil markets are closely linked to crude oil and other refined products, with price behavior often influenced by supply and demand factors, seasonal trends, and interactions with natural gas prices.

Both benchmarks rallied because markets felt more confident that summer demand – especially for gasoline and jet fuel – would beat earlier predictions [[4]](LINK 4). Heating oil demand typically rises during winter months, contributing to seasonal fluctuations in energy markets. Limited refining capacity in the U.S. and Europe keeps product cracks strong, which pushes crude prices even higher [[4]](LINK 5).

Markets felt better after:

- The U.S. and China agreed to pause new tariffs for 90 days, easing worries about global economic growth [[4]](LINK 6)[[2]](LINK 7)

- Chinese consumers spent more during May Day celebrations [[1]](LINK 8)

- Traders came back to markets after China’s five-day holiday [[1]](LINK 9)

Oil prices have always reacted strongly to geopolitical events, especially ones affecting major producing regions [[3]](LINK 10). The market looks tight right now, which shows in the futures curve structure. Many crude markets have switched to sustained backwardation – where near-term futures cost more than longer-dated ones – showing immediate supply is tight [[5]](LINK 11). The current supply demand balance is a key factor behind this backwardation, as limited inventories and strong demand are reflected in the futures market.

Oil prices don’t just depend on current supply and demand but also on what people think will happen in the future [[5]](LINK 12). OPEC+ decided to increase production, but markets saw this as a careful rather than aggressive move, which helped steady prices [[1]](LINK 13).

This time looks different from previous oversupply periods. Commercial oil stocks in advanced economies have dropped by a lot. Reports show floating storage has fallen below five-year averages, and traders have cleared out major onshore storage facilities [[5]](LINK 14).

These changes point to tighter global oil supply, which has temporarily pushed aside worries about increasedOPEC+ production and created good conditions for prices to recover.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

OPEC+ increases output by 411,000 barrels per day

OPEC+ and its allies have stepped up their collective oil output through coordinated increases. These petroleum exporting countries coordinate production quotas to manage global supply and influence prices. Eight OPEC+ countries have moved away from years of production restraint and announced a big boost of 411,000 barrels per day (bpd) for June. This marks a game-changing policy shift [[6]](LINK 2).

As these production cuts are unwound, expectations for future supply from OPEC+ decisions play a significant role in shaping market sentiment and futures pricing.

Saudi Arabia guides third consecutive monthly hike

Saudi Arabia has become the driving force behind faster production increases. The kingdom showed the biggest single-country increase in May, as its output went up by 130,000 bpd based on a Reuters survey [7]. This boost shows Saudi Arabia’s priorities as the group’s natural leader.

The June boost is the third monthly hike at this faster rate. The group had started with a small output increase in April before tripling the pace for May, June, and July production [8]. The eight participating countries have announced production increases of 1.37 million bpd since April. This is a big deal as it means that they’ve reached 62% of the 2.2 million bpd they want to bring back to the market [8].

Saudi Arabia seems to use its production capacity to pressure other OPEC+ members who’ve gone over their assigned quotas. Iraq and Kazakhstan are the main targets, with Kazakhstan reportedly producing 300,000 bpd above its limit [9].

These countries work together on the coordinated increases:

- Saudi Arabia (leading the increases)

- Russia

- Algeria

- Iraq

- Kazakhstan

- Kuwait

- Oman

- United Arab Emirates

People call these nations the “Voluntary Eight” or “V8,” and they handle two sets of voluntary production cuts [9]. One set of 1.66 million bpd stays active until next year’s end, while they now unwind the extra 2.2 million bpd they cut temporarily.

OPEC oil production still below pre-cut levels

OPEC’s overall production remains well below pre-cut levels despite these major increases. The organization pumped 26.75 million bpd in May, which was just 150,000 bpd more than April [[7]](LINK 1). This small actual increase highlights the gap between announced quotas and real production. Changes in global production levels directly impact market prices and supply-demand dynamics, making these figures critical for market analysis.

The group’s actual production increases haven’t kept up with targets as they speed up their plan to unwind output cuts. The Reuters survey shows that five OPEC members among the eight countries planned to raise output by 310,000 bpd in May, but only managed 180,000 bpd [[7]](LINK 2).

Iraq, Kuwait, and the UAE had to make compensation cuts of 165,000 bpd to make up for previous overproduction [[7]](LINK 3). Iraq cut its output in May to meet these commitments under pressure to follow OPEC+ quotas better [[7]](LINK 4).

OPEC+ has brought back only 1.2 million of the previously cut 2.2 million bpd to the market [[8]](LINK 5). Morgan Stanley analysts think the group could unwind all 2.2 million bpd of voluntary cuts by October if monthly increases continue at this rate [[3]](LINK 6).

These production increases align with seasonal factors that support higher oil demand. Summer brings more jet fuel and gasoline use for travel, while Middle Eastern countries burn more crude for electricity to power air conditioning [[9]](LINK 7). Saudi Arabia will likely burn more crude oil for power this summer than last year as it increases output while fuel oil gets pricier [[10]](LINK 8).

The oil market can handle these extra barrels, according to industry experts [[8]](LINK 9). Seasonal demand increases and declining U.S. production create conditions where these OPEC+ increases might not cause long-term price drops. Demand fundamentals, such as expectations for future consumption and inventory levels, are key to understanding current price trends.

Analysts say market remains tight despite production hike

The global oil supply remains tight even after OPEC+ decided to boost production by 411,000 barrels per day. Market analysts believe the recent WTI crude oil price surge comes from real market constraints rather than speculation. Price signals from futures trading and spot market activity help analysts interpret underlying supply-demand dynamics in commodity markets.

UBS: Market can absorb additional barrels

UBS market experts feel confident about the oil market’s ability to handle increased OPEC+ output. Their analysis shows that “the physical market continues to indicate some tightness, likely as a result of seasonally rising oil demand” [11]. This view challenges the idea that more production would automatically drive prices down.

UBS analysts back their position with several key indicators:

- Visible global inventories fell by approximately 14 million barrels between February and December 2024 [12]

- The decline points to a deficit of around 0.24 million barrels per day in January-February 2025 [12]

- The oil futures curve stays in backwardation (downward sloping), which typically shows an undersupplied market [12]

“While the market might be able to absorb those additional barrels, oil prices are likely to take such news negatively—at least temporarily,” UBS stated in their market outlook [11]. This explains why prices dropped right after the OPEC+ announcement but recovered when supply-demand basics came back into focus.

UBS thinks official market surplus forecasts might be too high. They point out that a surplus of 0.8 million barrels per day in Q1 2025 would mean “oil inventories would need to rise by almost 90 million barrels in March” [12]. Early March data doesn’t support these numbers.

Giovanni Staunovo from UBS acknowledged some bearish signals in reports that showed “large builds in refined products” [1]. The market balanced this out with “a strong increase in refinery demand for crude, resulting in a large crude draw” [1]. This shows physical crude markets remain tight.

Boockvar: Low prices are curing low prices

Peter Boockvar, who leads investments at Bleakley Advisory Group, brings a different view. He thinks current price levels already push production changes that will support higher prices—a pattern known as “low prices cure low prices” [[4]](LINK 1).

“The entire month of May, the rig count has fallen every week. And now for crude oil in particular, the rig count has fallen to the lowest level since 2021,” Boockvar said [[13]](LINK 2). Producers cut back on new production when prices stay low – a classic market response.

Boockvar spotted signs that “US Shale production is topping out here” [[13]](LINK 3). He explained it’s not just about prices: “It’s both… on a price basis, yes, they’re producing less, but on a geology basis, shale basins are topping out in terms of the production” [[13]](LINK 4). This follows the shale oil revolution of the 2010s, when advancements in hydraulic fracturing and horizontal drilling led to a surge in tight oil production, significantly increasing U.S. output and impacting global oil prices and market dynamics. Major shale producers like Diamondback Energy report similar geological limits to growth.

Boockvar believes that “energy oil prices here at USD 60.00 is dirt cheap” [[13]](LINK 5). He sees “we’re about to see an inflection point here to the upside” [[13]](LINK 6) in oil prices.

Goldman Sachs takes a different stance. They cut their WTI crude price forecast by USD 3.00 to USD 56.00 per barrel [[14]](LINK 7), citing “high spare capacity and high recession risk” [[14]](LINK 8). Yet, they recognize “relatively tight spot fundamentals” [[3]](LINK 9) in today’s market.

These varied outlooks highlight how current oil markets balance immediate physical conditions with longer-term supply-demand patterns.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

U.S. rig count hits lowest level since 2021

Image Source: Statista

U.S. active oil and gas rigs keep dropping steadily to their lowest numbers in over three years. Baker Hughes data shows the U.S. rig count dropped for six straight weeks through early June 2025. This marks the longest stretch of declines since mid-2023 [[15]](LINK 4).

Transportation constraints can create price disconnects between production areas and major consumption centers, impacting regional pricing dynamics.

Domestic drilling and operating activity declines

Baker Hughes data reveals the oil and gas rig count dropped by four to 559 in the week ending June 6, hitting its lowest point since November 2021 [16]. The numbers show a big drop of 37 rigs (6%) compared to last year [17]. Oil rigs took the biggest hit, falling by nine to 442 – a level not seen since October 2021 [18].

Different U.S. production regions show varying levels of decline:

- Permian Basin: The rig count fell to 275, down 35 from last year and the lowest since December 2021 [19] [2]

- Eagle Ford: Rigs decreased to 40, down 11 from the previous year [2]

- Haynesville: Operations shrank to just 33 rigs in September 2024, showing a 53% drop from January 2023 [5]

- Gulf of Mexico: Offshore operations dwindled to 9 rigs, matching September 2021’s low [19]

- Marcellus/Utica: Gas rigs dropped to 25 in the Marcellus and 7 in the Utica, roughly 36% and 50% lower than January 2023’s numbers [5]

Energy companies have reduced their rig count by about 5% in 2024 and 20% in 2023. They now focus on giving returns to shareholders and cutting debt instead of boosting output [17].

Effect on U.S. shale producers and oil supply

Several big shale producers have announced cuts in drilling. Diamondback Energy plans to remove three rigs in the second quarter and might cut back more if oil prices keep falling [[20]](LINK 1). Coterra Energy is scaling back its Permian operations by three rigs, while Matador Resources plans to remove one drilling rig by mid-2025 [[20]](LINK 2).

The industry faces more challenges beyond price concerns. Trump’s 25% tariff on steel imports has pushed up costs. Casing prices (steel pipe used in wells) jumped from $15 to $19 per foot. This adds about $64,000 to each well, nearly 10% more to the $650,000-700,000 cost of drilling and completing a well[[21]](LINK 4). Currency fluctuations can also impact the cost structure for U.S. producers, influencing their competitiveness in global markets.

U.S. crude production stays strong despite fewer rigs. The U.S. Energy Information Administration (EIA) expects crude output to grow from 13.2 million barrels per day (bpd) in 2024 to 13.4 million bpd in 2025 [[20]](LINK 5). Better technology explains this resilience. Artificial intelligence, electronic hydraulic fracturing, and automated drilling have made operations more efficient [[22]](LINK 7).

The Permian region shows this improved efficiency clearly. November’s crude oil productivity per active rig went up 9% compared to last year [[22]](LINK 8). The new Matterhorn Express pipeline has also removed previous production limits [[22]](LINK 9).

Market watchers see mixed signals from these opposing trends – fewer rigs but steady production. Higher OPEC+ output, modest U.S. crude supply growth, and possible future production drops have brought the Brent-WTI spread closer together [[15]](LINK 10). Futures trading allows market participants to hedge against price risks and manage exposure to potential supply changes.

Alternative Energy Sources and Their Impact

As the world seeks cleaner and more sustainable energy solutions, alternative energy sources like renewable energy and natural gas are playing an increasingly important role in the global energy mix. These alternatives can affect crude oil prices and the overall oil market by offering new options for power generation and transportation, which in turn can influence oil demand.

Efforts to reduce carbon emissions—such as the adoption of electric vehicles and stricter environmental policies—are driving the transition toward alternative energy sources and influencing long-term oil demand trends.

The expansion of renewable energy—such as wind, solar, and hydroelectric power—alongside the growing use of natural gas, has started to shift the dynamics of global energy consumption. As more countries invest in alternative energy sources, the demand for crude oil may decrease, potentially putting downward pressure on oil prices. However, despite these advances, crude oil remains the dominant energy source worldwide, especially in sectors like transportation and heavy industry where alternatives are not yet fully viable.

While the impact of alternative energy sources on the oil market is growing, it is still relatively limited compared to the scale of global oil consumption. Over time, as technology improves and adoption increases, these alternatives could play a larger role in shaping oil prices and market trends. For now, market participants continue to monitor developments in renewable energy and natural gas, recognizing their potential to affect crude oil prices and the future of the oil market.

Oil Price Volatility and Demand Shocks

Oil price volatility is a defining feature of the global oil market, often creating both challenges and opportunities for market participants. Price volatility refers to the rapid and sometimes unpredictable changes in oil prices, which can be triggered by a variety of factors. One of the most significant drivers of oil price volatility is demand shocks—sudden changes in global oil demand that can send prices soaring or tumbling.

For example, a sharp decrease in global oil demand, whether due to an economic slowdown, changes in consumer behavior, or unexpected events, can lead to lower oil prices. Conversely, a surge in demand—perhaps from emerging economies or seasonal factors—can push prices higher. These demand shocks can have far-reaching effects on the global economy, influencing everything from inflation to trade balances.

Understanding the causes of oil price volatility is essential for market participants, including producers, investors, and policymakers. By anticipating potential demand shocks and their impact on oil prices, stakeholders can make more informed decisions about investments, risk management, and strategic planning. In a market where price volatility is the norm, staying ahead of demand dynamics is key to navigating the ever-changing landscape of global oil.

Technical Factors and Oil Price Movements

Beyond fundamental supply and demand, technical factors play a crucial role in shaping oil price movements. Futures contracts—agreements to buy or sell oil at a predetermined price on a future date—are a cornerstone of the oil market. These contracts allow market participants to hedge against price risks, manage exposure, and even speculate on future price trends.

Market sentiment, or the collective outlook and attitude of traders and investors, also has a powerful influence on oil price movements. When sentiment is bullish, meaning market participants expect prices to rise, increased buying activity can drive oil prices higher. Conversely, bearish sentiment can lead to selling and downward price pressure.

The interplay between futures contracts and market sentiment often leads to rapid price movements, especially when unexpected news or data releases shift expectations. For example, a sudden change in weekly inventory data or a surprise geopolitical development can trigger significant swings in oil prices as traders adjust their positions.

By understanding these technical factors, market participants can better anticipate price movements and make strategic decisions in the oil market. Whether managing risk through futures contracts or gauging the mood of the market, staying attuned to these influences is essential for success in the dynamic world of crude oil trading.

Goldman Sachs maintains oil price forecast despite surplus

Goldman Sachs managed to keep its oil price forecasts through 2026, even with market surplus predictions. The bank’s position comes from analyzing several factors that affect global oil markets, including higher non-OPEC production and changing demand patterns. Energy markets are highly interconnected and influenced not only by supply-demand dynamics but also by broader economic conditions.

When considering different scenarios for oil prices, it is important to note that a global economic crisis can have far-reaching effects on energy markets and price stability.

After discussing price forecasts and market surplus, the role of energy economics becomes crucial in analyzing oil price forecasting, understanding market asymmetries, and assessing the macroeconomic impact of oil prices.

Oil prices forecast for 2024 and 2026

Goldman Sachs sees Brent crude at $56 per barrel and WTI crude at $52 per barrel by December 2026 [8]. The prices show an $8 drop below current forward prices [9]. The bank expects “large surpluses” in the oil market that could reach 800,000 barrels per day in 2025 and expand to 1.4 million barrels per day in 2026 [23].

Goldman Sachs predicts these prices for the rest of 2025:

These numbers depend on two conditions: The U.S. economy stays recession-free thanks to lower tariffs, and OPEC+ countries increase supply with final additions of 130,000-140,000 barrels each in June-July [7].

The outlook changes based on different scenarios:

- A typical U.S. recession would push Brent down to $58 by December 2025 and $50 by December 2026 [7]

- A global GDP slowdown could drive Brent to $54 by December 2025 and $45 by December 2026 [7]

- Both global slowdown and complete removal of OPEC+ cuts might send Brent prices below $40 per barrel by late 2026 [7]

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

WTI crude oil price forecast 2025 remains stable

Goldman Sachs sticks to its WTI crude oil price forecast for 2025, while raising its global oil demand outlook. The bank now expects global oil demand to grow by 600,000 barrels daily in 2025 and 400,000 barrels daily in 2026 [[10]](LINK 1). Fluctuations in global demand can significantly impact global oil prices and inventory levels, shaping market dynamics and influencing price trends worldwide.

The bank points to rising oil production from non-OPEC nations (excluding Russia and U.S. shale) as the biggest factor. These producers should boost output by about 1 million barrels per day over the next two years[[24]](LINK 3).

The bank’s research team also highlights President Trump’s preference for keeping WTI between $40 and $50 a barrel. His nearly 900 social media posts about oil prices support this observation [[9]](LINK 4), adding another layer to the market’s future. Natural gas prices also interact with oil prices, influencing broader energy market dynamics and investment decisions.

What this means for oil and gas investments

Oil prices have been going up and down lately. These WTI crude oil price changes create great opportunities for investors who want to vary their portfolios with oil and gas assets. The prices react to tightening global supply conditions. Geopolitical risk, such as regional conflicts or policy changes, can create significant volatility in commodity markets and affect investment outcomes. Working interest investments let investors take part in this vital market.

Oil and gas working interest opportunities

Working interest gives investors ownership in oil and gas operations. Investors can take part in exploration, drilling, and production activities. The current market conditions make working interest attractive with several benefits:

- Substantial profit potential from successful wells that create lasting revenue streams

- Most important tax benefits include deductions for intangible drilling costs (IDCs), which make up 60-80% of total drilling expenses [6]

- Tangible drilling costs are 100% tax deductible but depreciated over seven years [6]

- Depletion allowance lets 15% of gross production revenue stay tax-free throughout the well’s lifetime [25]

Working interests come in three main types. Operating working interests handle day-to-day operations. Non-operating interests give ownership rights without operational duties. Carried working interests create partnerships where multiple parties join resources through joint ventures [26].

How to invest with Domestic Operating

Domestic Operating gives qualified investors access to oil and gas working interests. These investments benefit from the Tax Reform Act of 1986, which keeps them separate from “passive income” classification [25]. This difference allows active income deductions that offset various income sources like business income, salaries, and capital gains [25].

Investing through Domestic Operating helps you diversify your portfolio during WTI crude oil price changes. The company puts money into tangible assets that offer several key advantages:

- Regular cash flow from producing wells

- Hedge against inflation through physical asset ownership

- Energy independence contribution through domestic resource development

- Technological advances help maximize well productivity [25]

Domestic Operating’s approach helps investors worried about recent oil price swings. The company spreads investments across multiple prospects. This strategy helps alleviate dry-hole risk through a disciplined methodology [27].

The global oil markets face a pivotal moment as June 2025 unfolds. Recent price surges show fundamental changes in supply-demand dynamics. WTI crude oil’s 3% jump reveals more than regular market volatility and signals a potential watershed moment after months of downward pressure.

The complex market environment stems from OPEC+ production decisions and declining U.S. drilling activity. Saudi Arabia guides the gradual return of 2.2 million barrels per day to global markets. Yet the drop in U.S. shale activity could end up having greater impact on medium-term pricing.

Seasonal demand factors will boost this price recovery. Summer drivers in the Northern Hemisphere increase gasoline consumption. Middle Eastern countries also burn more crude for electricity when cooling demand peaks. These seasonal patterns combined with tight physical markets point toward sustained higher prices.

Market participants now believe structural supply limits outweigh temporary production increases. Near-term contracts trade at premiums to longer-dated ones, showing immediate market tightness through persistent backwardation in futures curves.

Investors see both challenges and opportunities in these conditions. The sector could gain renewed attention as reduced drilling activity, strong demand, and disciplined OPEC+ management alter the market fundamentals.

Oil markets seem ready for continued recalibration through 2025. Current price movements tell us that oil markets remain dynamic and vital to the global economy. This holds true whatever they match with Goldman Sachs’ conservative forecasts or reflect the more bullish outlook from declining rig counts.

FAQ

What caused the recent surge in oil prices?

Oil prices jumped due to tightening global supply, increased demand expectations in key markets, and geopolitical tensions. The market also interpreted OPEC+’s measured production increase as a sign of continued supply constraints.

How has U.S. oil production been affected by recent market changes?

U.S. oil production has seen a decline in drilling activity, with the rig count falling to its lowest level since 2021. This reduction in domestic drilling could potentially boost prices by constraining future output.

What is the current outlook for WTI crude oil prices?

While forecasts vary, some analysts expect WTI crude to average around $56 per barrel for the remainder of 2025. However, this outlook could change based on factors such as economic conditions and OPEC+ decisions.

How are OPEC+ production increases impacting the oil market?

Despite OPEC+ increasing production, the market remains relatively tight. The group has only returned about 1.2 million of the previously cut 2.2 million barrels per day, and analysts suggest the market can absorb these additional barrels.

What opportunities do current oil market conditions present for investors?

The fluctuating oil prices create opportunities for portfolio diversification through oil and gas assets. Working interest investments offer direct participation in the market, with potential benefits including profit potential, tax advantages, and regular cash flow from producing wells.

Economic Factors Influencing Oil Prices

Economic factors are a major force behind the movement of crude oil prices. The health of the global economy, including trends in economic growth, inflation, and interest rates, directly affects oil demand and, consequently, oil prices. When the global economy is expanding, industries ramp up production, transportation activity increases, and consumers spend more—all of which drive up oil demand and can lead to higher crude oil prices. Conversely, during periods of economic slowdown or recession, oil demand typically falls, resulting in lower crude oil prices as consumption contracts.

Inflation and interest rates also play a role in shaping oil prices. Higher inflation can increase the cost of oil production and transportation, while rising interest rates may slow economic growth and reduce oil demand. Additionally, currency fluctuations—especially changes in the value of the US dollar—can significantly affect crude oil prices. Since oil is traded globally in dollars, a stronger dollar makes oil more expensive for buyers using other currencies, potentially dampening demand and putting downward pressure on oil prices. On the other hand, a weaker dollar can make oil more affordable internationally, supporting increased demand and higher prices.

Ultimately, the interplay between economic growth, currency movements, and financial market conditions creates a dynamic environment where crude oil prices are constantly adjusting to new information and shifting expectations about the global economy.

Regional Markets and Their Influence on Oil Prices

Regional markets play a crucial role in determining crude oil prices and shaping the overall oil market landscape. The global oil market is not a monolith; instead, it is made up of interconnected regional markets, each with its own benchmarks, infrastructure, and demand patterns. For example, the US market is heavily influenced by the West Texas Intermediate (WTI) crude oil benchmark, which reflects supply and demand dynamics in North America. In contrast, the European market relies on Brent crude oil as its primary benchmark, while Asian markets often look to Dubai or Oman grades.

These regional differences can lead to variations in crude oil price movements, as local factors such as refining capacity, transportation bottlenecks, and regulatory policies come into play. For instance, a disruption in US pipeline infrastructure can cause WTI crude oil prices to diverge from Brent crude oil prices, even if global supply and demand remain unchanged. Similarly, seasonal demand spikes in Asia or Europe can create temporary price premiums in those regions.

Understanding the influence of regional markets is essential for anyone tracking crude oil prices or making investment decisions in the oil market. By monitoring benchmarks like WTI crude, Brent crude, and others, market participants can gain valuable insights into how local events and trends are affecting the broader global oil market and driving price movements.

Global Oil Trends Shaping the Market

The global oil market is constantly evolving, shaped by a range of powerful trends that influence crude oil prices and the direction of oil markets worldwide. One of the most significant trends is the rise of alternative energy sources, including renewable energy and natural gas. As countries invest more in wind, solar, and other renewables, and as natural gas becomes a more prominent part of the energy mix, the demand for crude oil may decrease over time, potentially leading to lower oil prices.

At the same time, emerging economies such as China and India are playing an increasingly important role in global oil demand. Rapid industrialization, urbanization, and population growth in these countries are driving up oil consumption, which can put upward pressure on crude oil prices and contribute to significant price fluctuations in global oil markets.

The shale oil revolution in the United States has also transformed the global oil landscape. Advances in drilling technology have unlocked vast reserves of tight oil, boosting US oil supply and making the country a major player in global oil markets. This surge in supply has helped moderate oil prices and increased market competition.

Finally, geopolitical developments remain a key source of volatility in the oil market. Conflicts in major oil-producing regions, changes in government policies, and international sanctions can disrupt oil supply chains and trigger sharp price movements. As these global trends continue to unfold, they will shape the future of crude oil prices and the dynamics of the global oil market.

Conclusion: The Road Ahead for Oil Markets

The crude oil market stands at a crossroads, shaped by a complex interplay of economic growth, regional dynamics, and global trends. For market participants—including oil producers, refiners, and investors—understanding these factors is essential for navigating the ever-changing landscape of crude oil price movements. As the global economy evolves and alternative energy sources gain traction, the oil market will continue to adapt, presenting both challenges and opportunities.

Staying informed about supply and demand fundamentals, geopolitical risk, and financial market trends is critical for making sound investment decisions in the oil market. By analyzing how economic growth, regional benchmarks like West Texas Intermediate and Brent, and emerging global trends affect crude oil prices, market participants can better anticipate price movements and position themselves for success.

Looking ahead, the oil market is likely to experience further transformation as new technologies, policy shifts, and changing consumption patterns reshape the industry. Those who remain vigilant and adaptable—tracking the latest developments in the global oil market—will be best equipped to capitalize on opportunities and manage risks in this vital sector of the global economy.

What caused the recent surge in oil prices?

Oil prices jumped due to tightening global supply, increased demand expectations in key markets, and geopolitical tensions. The market also interpreted OPEC+'s measured production increase as a sign of continued supply constraints.

How has U.S. oil production been affected by recent market changes?

U.S. oil production has seen a decline in drilling activity, with the rig count falling to its lowest level since 2021. This reduction in domestic drilling could potentially boost prices by constraining future output.

What is the current outlook for WTI crude oil prices?

While forecasts vary, some analysts expect WTI crude to average around $56 per barrel for the remainder of 2025. However, this outlook could change based on factors such as economic conditions and OPEC+ decisions.

How are OPEC+ production increases impacting the oil market?

Despite OPEC+ increasing production, the market remains relatively tight. The group has only returned about 1.2 million of the previously cut 2.2 million barrels per day, and analysts suggest the market can absorb these additional barrels.

What opportunities do current oil market conditions present for investors?

The fluctuating oil prices create opportunities for portfolio diversification through oil and gas assets. Working interest investments offer direct participation in the market, with potential benefits including profit potential, tax advantages, and regular cash flow from producing wells.