The total number of active drilling rigs for oil and gas in the United States experienced a slight decline this week, according to the latest comprehensive data released by Baker Hughes on Friday. The active rig count remains a key indicator tracked by Baker Hughes to monitor drilling activity across the country. Compared to last week, this represents a continued downward trend in US rig counts. The oil-directed rig count has dropped 33% to 397 rigs in October 2025 since December 2022. While there has not been a significant rise in rig activity or oil prices recently, market watchers remain alert for any upward movement.

Call Domestic Drilling and Operating Today to invest in our newest project. For more information or assistance, contact our team directly.

This trend continues to impact working interest owners and energy investments across the domestic energy sector, highlighting the ongoing operational risks in exploration and drilling activities.

This chart was created with Highcharts (version 11.1.0) and was created to visualize the rig count data over time.

Introduction to the Industry

The oil and gas industry stands as a cornerstone of the global energy sector, with the United States recognized as a leading provider of both crude oil production and natural gas production. This dynamic industry encompasses the exploration, extraction, processing, and distribution of oil and natural gas, fueling economies and supporting a wide range of industries. Central to understanding the health and direction of the sector are active drilling rigs and rig counts, which serve as vital indicators of drilling activity and future production trends. However, insufficient investment in new drilling programs risks creating future supply shortages if demand does not peak as quickly as some forecasts suggest, adding a layer of uncertainty to the industry’s outlook. Geopolitical tensions and a global push toward lower-carbon energy systems create long-term uncertainty impacting investment in the oil and gas sector. Capital discipline is leading operators to prioritize profitability and shareholder returns over aggressive production growth, reducing expenditures on new drilling.

The Energy Information Administration (EIA) plays a crucial role in supplying comprehensive data and analysis on oil production, natural gas production, oil prices, and natural gas prices. By tracking the number of active drilling rigs and monitoring shifts in rig counts, the EIA enables companies, operators, and investors to make informed decisions about energy investments and operational strategies. As the industry continues to evolve, access to timely and accurate data remains essential for navigating the complexities of oil and gas production in a competitive global market. The EIA forecasts Lower 48 crude oil production in 2026 to decline slightly by 0.1 million barrels per day.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

Current Rig Count Analysis

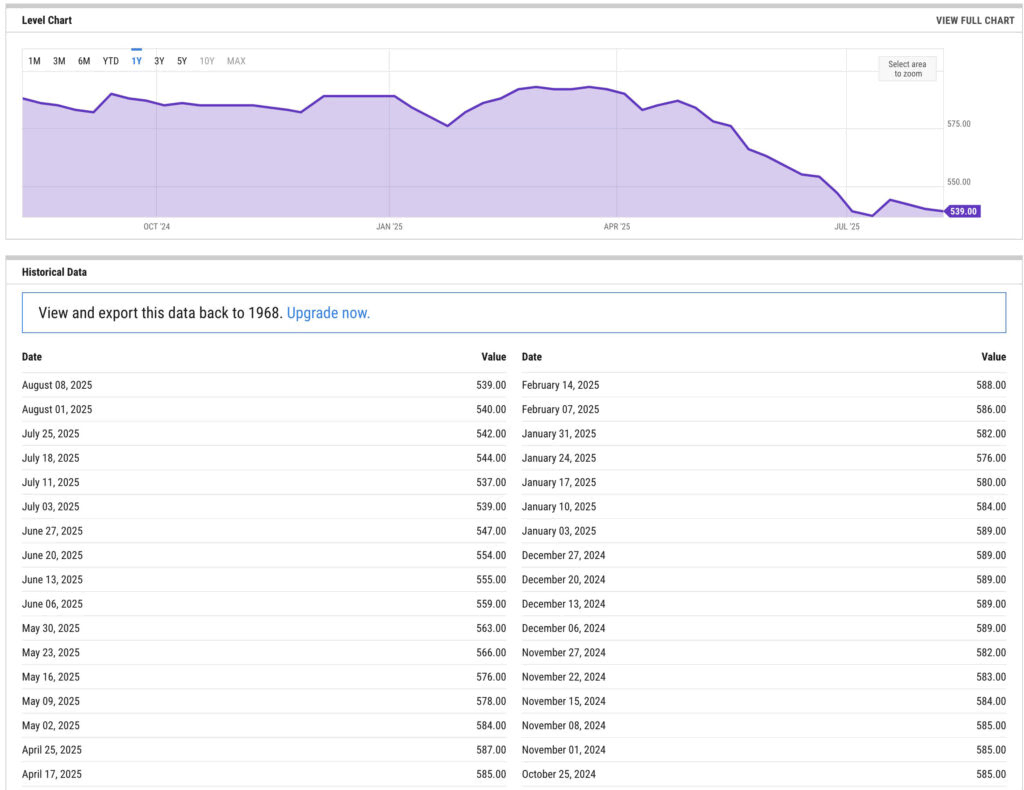

The total rig count in the US decreased by 1 rig, settling at 539, according to Baker Hughes’ detailed report. This represents a significant decline of 49 rigs from the year ago period. The previous week’s count of 538 marked the lowest point in domestic production activities since December 2021, emphasizing the challenges faced by those involved in operating working interests in the oil and gas industry.

In terms of specific working interest in oil and gas operations, the oil rig count showed a modest increase of 1 to reach 411, though this still reflects a substantial decline of 74 rigs compared to a year ago. The gas rig count experienced a reduction of 1 rig this week, totaling 123 active rigs, which actually represents a gain of 26 active gas rigs compared to the year ago levels. The miscellaneous rig category also saw a decrease of one rig this week, following last week’s single-rig gain, bringing the total number of active miscellaneous rigs to 5. These fluctuations in rig counts directly impact drilling costs and well completion activities across various energy projects.

Production and Completion Activity Trends

Recent data from the Energy Information Administration (EIA) revealed that weekly U.S. crude oil production experienced a slight decrease in the week ending August 1, dropping from 13.314 million barrels per day to 13.284 million barrels per day. This fluctuation has implications for working interest owners and domestic production strategies in the energy market. Based on current trends, future production and completion activity is expected to remain subdued unless there is a significant change in market conditions.

Primary Vision’s Frac Spread Count, which provides a crucial metric for evaluating completion activity in the oil and gas sector, indicated a decrease of 1 during the week of August 1, bringing the total to 167 active crews. This chart was created by Primary Vision to track weekly changes in frac crew activity. This represents the lowest level of active frac crews since 2021, highlighting the ongoing adjustments in domestic drilling and operating activities. The current count shows a significant decline of 48 crews from the March 21 peak, reflecting broader industry trends and operational challenges facing energy investments in drilling projects.

The reduction in frac crews is particularly significant as it indicates not just fewer new wells being drilled, but also fewer existing wells being completed and brought into production. This bottleneck in completion activities suggests that even when drilling does pick up, there may be delays in bringing new production online, potentially extending the current period of constrained supply growth.

Regional Basin Performance

Drilling activities in the Permian basin, a crucial region for energy investments, continue to show concerning trends, with the basin experiencing a notable 3-rig reduction this week. The current count of 256 rigs represents a significant year-over-year decline of 48 rigs, impacting exploration and drilling activities throughout the region. The Eagle Ford basin, another key area for oil and gas working interest owners, also witnessed a downturn, losing one rig to reach 38 total—marking a decrease of 12 rigs compared to the previous year. These declines highlight the ongoing production costs and operational risks faced by investors in these major U.S. basins. Changes in rig activity also directly affect oilfield service companies operating in these basins, as reduced drilling can decrease demand for their service offerings and impact their cash flow.

The Permian basin’s struggles are particularly noteworthy given its status as America’s premier shale oil region. The basin has historically driven much of the growth in U.S. oil production over the past decade, making its current challenges a bellwether for the broader industry. There has traditionally been a strong link—often referred to as the ‘traditional link’—between rig activity and oil and natural gas production in the Permian and Eagle Ford basins. However, this relationship has weakened recently due to increased drilling efficiency and longer lateral wells, allowing higher output even with fewer active rigs. Similarly, the Eagle Ford’s continued weakness reflects the maturation of many of its most prolific drilling locations, forcing operators to move to less attractive acreage or implement more expensive enhanced recovery techniques.

Natural Resources

The United States is endowed with abundant natural resources, making it a global leader in crude oil and natural gas production. The Permian Basin, stretching across western Texas and southeastern New Mexico, stands as the nation’s largest crude oil producing region, consistently delivering high levels of output. Similarly, the Eagle Ford shale play in southern Texas has emerged as a major contributor to both oil and gas production, supporting the country’s energy independence.

Natural gas production has also surged to unprecedented levels, with the Appalachian region and the Haynesville shale play driving much of the recent growth. According to the Energy Information Administration, US natural gas production has reached an all-time high, with average daily output now exceeding 117.2 billion cubic feet. These prolific basins not only bolster the country’s energy security but also provide significant opportunities for companies, operators, and investors seeking to capitalize on the robust oil and gas sector.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

Market Price Dynamics and Economic Pressures

Market indicators at 12:45 p.m. ET showed mixed signals for energy investments. The WTI benchmark demonstrated modest gains, with oil prices trading up $0.16 per barrel (+0.25%) at $64.04, though this still reflected a substantial decline of more than $3 per barrel from the previous week’s levels. Similarly, the Brent benchmark showed slight improvement, with gas prices trading up $0.25 (+0.38%) at $66.68. These price movements continue to influence investment decisions in domestic drilling and operating ventures, particularly for those holding working interests in oil and gas projects across major U.S. basins.

The current price environment reflects several competing factors. While global demand remains relatively robust, concerns about economic slowdowns in major consuming regions continue to weigh on sentiment. Additionally, the substantial increase in production efficiency over recent years means that many wells remain profitable even at current price levels, though the economic incentive for aggressive expansion has diminished significantly.

Technology and Operational Efficiency Factors

The industry’s focus has increasingly shifted toward operational efficiency and technology adoption as companies work to maintain profitability in a challenging price environment. Advanced drilling techniques, including longer lateral wells and improved completion designs, have allowed operators to extract more resources from existing acreage while reducing per-unit costs. However, these technological improvements also mean that fewer rigs are needed to maintain production levels, contributing to the overall decline in active rig counts.

Automation and digitalization initiatives are also playing a growing role in rig efficiency. Modern drilling operations can accomplish in weeks what previously took months, allowing companies to maintain production with fewer active rigs. This technological evolution represents both a challenge and an opportunity for working interest owners, as it requires ongoing capital investment but potentially offers improved returns on successfully implemented projects.

Rig Operations

Rig operations across the United States have evolved rapidly, with operators leveraging advanced drilling and completion techniques to maximize output from each well. The Energy Information Administration (EIA) notes that the traditional link between the number of active drilling rigs and overall oil and natural gas production has weakened recently. This shift is particularly evident in prolific basins like the Permian, where oil production has surged even as rig counts have declined. Operators are now able to access more hydrocarbons with fewer rigs, thanks to improvements such as longer lateral drilling and more efficient completion strategies. Technological advancements such as horizontal drilling and advanced fracking allow operators to extract more resources per well, necessitating fewer rigs to maintain or increase output. These advancements have enabled the industry to achieve record highs in crude oil and natural gas production, despite a reduction in the total number of active rigs. As a result, the focus has shifted from simply increasing rig activity to optimizing each rig’s performance, ensuring that production remains robust even as the overall rig count trends lower.

Industry Insights

The oil and gas sector is experiencing a period of transformation, driven by a relentless pursuit of efficiency and technological innovation. Companies are increasingly prioritizing operational improvements that allow them to sustain or even boost crude oil and natural gas production with fewer active drilling rigs. This trend is reflected in the industry’s ability to maintain record production levels, even as rig counts decline. Operators are strategically targeting the most productive plays and deploying advanced drilling rigs and completion technologies to maximize returns. The shift toward more cost-effective operations has enabled many companies to remain profitable, even when oil and gas prices are under pressure. As a leading provider of industrial market intelligence, Industrial Info Resources tracks a vast array of projects and developments, offering valuable insights into how companies are adapting to these changes. The industry’s focus on innovation and efficiency is expected to continue shaping production trends and investment strategies in the years ahead.

US Energy Landscape

The US energy landscape is marked by a dynamic balance between rig counts, production trends, and market prices. According to the Energy Information Administration, crude oil production in the Lower 48 states reached an all-time high of 11.4 million barrels per day in July 2025, while natural gas production soared to a record 117.2 billion cubic feet per day in August 2025. Despite a decrease in the number of active drilling rigs over the past year, these production milestones highlight the impact of ongoing improvements in drilling and completion techniques. The Permian Basin remains the nation’s top crude oil producing region, with the Eagle Ford in Texas also playing a significant role in supporting US oil and gas output. The US rig count, a key indicator of industry activity, stood at 554.00 as of the previous week—a 5.14% decline from the same period last year. These figures underscore the resilience of US oil and gas production, as operators continue to adapt to changing market conditions and leverage technological advancements to drive efficiency and growth across major basins.

Investment Implications and Market Outlook

The current market conditions and operational challenges in the energy sector underscore the importance of careful consideration for investors looking at energy investments. While the industry faces headwinds, it also presents unique investment opportunities for those willing to navigate the complexities of operating working interests in oil and gas projects. Analysts warn that the declining rig count could lead to future production declines, as efficiency gains may not fully offset the loss of drilling activity. As the domestic production landscape continues to evolve, working interest owners must stay informed about the latest trends in drilling costs, well completion techniques, and overall market dynamics to make informed decisions about their investments in this vital sector of the U.S. economy.

These figures underscore the complex dynamics currently affecting the domestic energy sector, particularly for those holding operating working interests in oil and gas operations. The data suggests a period of adjustment in the industry, with implications for both current operations and future investment opportunities in domestic drilling and operating ventures. Investors should closely monitor key indicators such as rig counts, completion activity, and regional performance metrics to identify potential opportunities in this evolving market landscape.

For working interest owners, the current environment may present opportunities to acquire interests in quality projects at attractive valuations, particularly in proven basins where infrastructure and geological knowledge provide competitive advantages. However, thorough due diligence remains essential, as the industry continues to navigate the balance between maintaining production levels and preserving capital in an uncertain economic environment.

Frequently Asked Questions

What does the Baker Hughes rig count actually measure?

The Baker Hughes rig count tracks the number of active drilling rigs operating in the United States on a weekly basis. This includes oil rigs, natural gas rigs, and miscellaneous rigs engaged in exploration, development, and production activities. The count serves as a leading indicator of industry activity and future production capacity, as more active rigs typically signal increased drilling and potential production growth. The Baker Hughes Crude Oil Rigs is projected to trend around 440.00 in 2026 and 460.00 in 2027, reflecting expectations of gradual recovery in drilling activity over the coming years.

Why has the US rig count declined to 3-year lows?

The decline to 3-year lows reflects several factors including volatile oil and gas prices, economic uncertainty, and improved drilling efficiency. Companies have become more selective about new projects, focusing on their most profitable acreage. Additionally, technological advances mean fewer rigs are needed to maintain production levels, as modern drilling techniques can extract more resources per well than previous methods.

How does the reduced rig count affect working interest owners?

Reduced rig activity can impact working interest owners in multiple ways. While fewer active projects may limit new investment opportunities, it can also create attractive entry points for quality assets at lower valuations. The key is focusing on projects in proven basins with existing infrastructure and strong geological data, where the risk-return profile remains favorable even in a challenging market environment.

What makes the Permian basin so important to US drilling activity?

The Permian basin represents America's most prolific shale oil region, historically driving much of the growth in US oil production over the past decade. With 256 active rigs (despite recent declines), it still accounts for nearly half of all US drilling activity. The basin's importance stems from its proven reserves, existing infrastructure, and relatively low breakeven costs compared to other regions. Horizontal wells accounted for 94% of crude oil production and 92% of natural gas production from the Lower 48 states at the end of last year, underscoring the critical role of advanced drilling techniques in maintaining high output levels.

Should investors be concerned about the current drilling slowdown?

While the current slowdown presents challenges, it may also create opportunities for informed investors. The industry is experiencing a period of adjustment rather than permanent decline. For those considering domestic drilling and operating investments, the focus should be on projects with strong fundamentals, experienced operators, and locations in proven basins where operational efficiency and existing infrastructure provide competitive advantages.