The International Energy Agency (IEA) has just released a groundbreaking forecast that challenges previous assumptions about the future of global oil demand. Tax advantages and technological innovations in the oil and gas sector further incentivize investment, with companies like Domestic Drilling and Operating leveraging decades of industry experience to optimize returns for investors. Contrary to earlier expectations that global oil consumption would peak within this decade, the IEA now projects a steady rise in global oil demand through 2050. This new outlook marks a significant shift in how market participants, including investors, companies, and policymakers, view the long-term trajectory of crude oil prices and energy consumption worldwide.

Crude oil remains a cornerstone commodity in global energy markets, with oil prices heavily influenced by supply and demand dynamics, inventory levels, and geopolitical developments. Oil continues to play a critical role in supporting global energy security by ensuring stable and reliable energy supplies amid shifting geopolitical and economic conditions. While production from non-OPEC+ countries such as the United States, Brazil, Canada, and Guyana continues to outpace demand growth, emerging markets are driving sustained increases in oil consumption. These economies typically experience a strong correlation between GDP growth and oil demand due to rapid industrialization and urbanization. In contrast, advanced economies see less sensitivity in oil consumption relative to GDP growth, thanks to improved fuel efficiency, a shift toward service-based industries, and policies promoting alternative energy sources. Oil consumption patterns diverge significantly between advanced and emerging economies, with the latter experiencing persistent demand growth driven by rising populations and economic development.

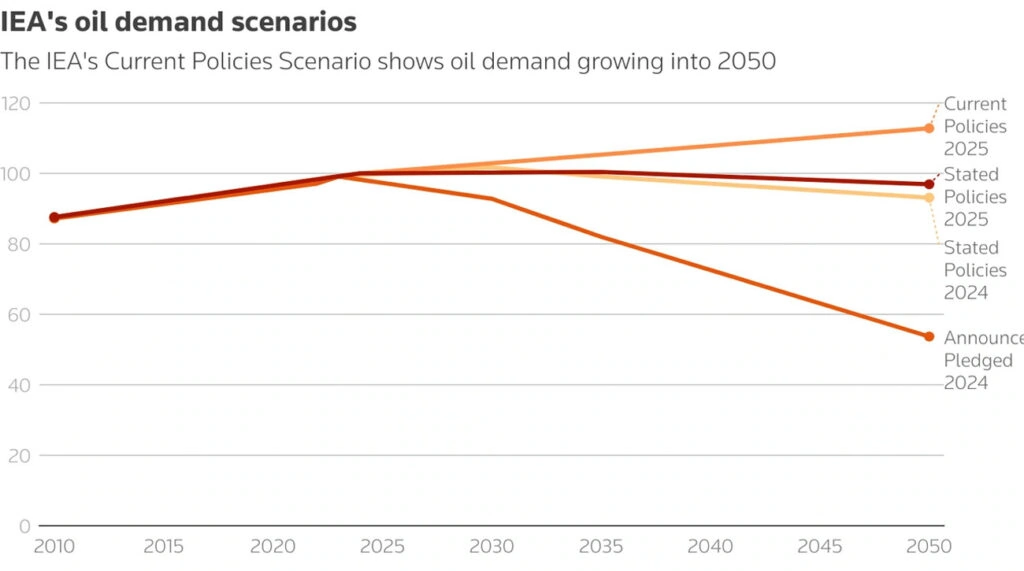

The IEA’s Current Policies Scenario forecasts that global oil demand will reach 113 million barrels per day by 2050, representing a 13% rise from 2024 levels. These projections are updated month by month to reflect changing market conditions and inventory builds. Alongside this, global energy needs are expected to increase by 90 exajoules by 2035, a 15% jump from current consumption. These figures signal a fundamental transformation in energy outlooks and challenge the timelines for the energy transition that many experts had anticipated. Additionally, the IEA projects a peak in global gasoline demand around 2025, reflecting changing consumption patterns and efficiency gains. Meanwhile, OPEC+ has begun to unwind voluntary production cuts, contributing to a current and projected supply surplus in the oil market. OPEC+ has also announced production targets for November 2025, which fit into the ongoing supply adjustments. OPEC+ production is close to its set targets, and observed inventory levels are close to estimated norms, which could have important market implications.

Natural gas demand is also on an upward trajectory, with global consumption expected to reach 5.6 billion cubic meters by 2050. Asian economies will lead this growth, supported by new pipeline infrastructure from Russia to China and rapid expansion in liquefied natural gas (LNG) capacity. Investment decisions for new LNG projects are expected to surge in 2025, with approximately 300 billion cubic meters of new annual export capacity coming online by 2030—boosting supply by about 50%. Global liquid fuels production is forecasted to increase by 2.7 million barrels per day in 2025 and another 1.3 million barrels per day in 2026, further shaping the evolving energy landscape. These year-by-year projections clarify the timeline for expected changes in the market.

These projections indicate a significant shift in the global fossil fuel outlook. Energy market watchers, investors, and climate analysts alike should take note of the implications. The following sections delve into how political dynamics are reshaping energy forecasts, the consequences for climate goals, and the role of LNG expansion and electric vehicle adoption in the future energy mix. Staying informed is crucial as the global energy landscape evolves rapidly ahead.

If you access our reports or take advantage of a free trial or subscription offer, you can cancel your subscription or trial at any time without penalty.

IEA Projects Oil Demand to Hit Record Levels by 2050

Image Source: Reuters

The International Energy Agency’s new long-term outlook reveals that global oil demand will continue to grow steadily over the next 25 years. This represents a major departure from previous forecasts that anticipated peak oil demand within this decade. The IEA’s shift in perspective reflects changing realities in global energy consumption patterns and policy environments.

Global Oil Demand Forecast Reaches 113 Million Barrels Per Day

According to the IEA’s latest data, global oil demand is expected to rise from approximately 100 million barrels per day in 2024, to 105 million barrels per day by 2035, and to 113 million barrels per day by 2050, in each respective year. This marks a 13% increase from today’s levels. This growth is not uniform across the globe. Emerging and developing economies will drive most of the increase, fueled by rising populations, economic development, and higher incomes. These factors contribute to increased car ownership and energy consumption, particularly in sectors such as road transport, petrochemical feedstocks, and aviation.

India stands out as a major contributor to this demand surge, with oil consumption projected to grow by two million barrels per day by 2035—the largest increase of any country—and continuing to rise through 2050. Market participants, including energy companies, investors, and governments, will play a critical role in shaping these trends through their production strategies, investment decisions, and policy frameworks.

Natural Gas Demand Also Expected to Rise Significantly

Alongside oil, natural gas consumption is forecasted to expand substantially, reaching 5.6 billion cubic meters by the year 2050. The Middle East and developing Asian economies are the primary growth drivers, with new pipeline projects connecting Russia to China enhancing supply security. The global LNG market is projected to grow from about 560 billion cubic meters in the year 2024 to 880 billion cubic meters by the year 2035, and further to 1,020 billion cubic meters by the year 2050. This surge is partly driven by increasing power needs from data centers and artificial intelligence technologies, which are becoming significant energy consumers.

IEA’s Current Policies Scenario Forms the Basis of Projection

The IEA’s projections are grounded in the Current Policies Scenario (CPS), which assesses oil demand based on existing government policies and regulations rather than aspirational climate goals. This marks a notable shift from previous IEA reports that emphasized clean energy transition scenarios. While many energy agencies still anticipate a peak in global oil demand between 2028 and 2030 due to the acceleration of renewable energy adoption and plateauing consumption in advanced economies, the IEA’s CPS suggests ongoing demand growth.

It is important to recognize that these scenario-based forecasts carry risks and uncertainties. Geopolitical tensions, sanctions, production constraints, and policy changes could all influence future oil demand and market stability. Economic slowdowns tend to reduce industrial activity, thereby lowering oil consumption. Similarly, accelerated adoption of clean energy technologies could dampen demand growth. Consistent communication with partners is crucial for trust and mutual understanding in investments, especially in a volatile energy market. Market participants must stay vigilant to these evolving factors.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

Political Pressure Reshapes IEA’s Energy Outlook

The IEA’s updated global oil demand forecast reflects more than just market data; it underscores a significant political shift influencing energy outlooks. The ongoing debate over fossil fuel investments and their role in shaping the IEA’s updated forecast highlights the complex interplay between policy decisions and the future of oil.

Trump Administration Criticized IEA’s Clean Energy Focus

During the previous U.S. administration, officials strongly criticized the IEA’s emphasis on clean energy transitions and climate-focused scenarios. They argued that such projections undermined investments in fossil fuels, which they viewed as essential for global energy security. This political pressure intensified as the IEA’s World Energy Outlook increasingly highlighted pathways to achieve net-zero emissions, creating friction with oil-producing nations and industry stakeholders.

Shift from Net-Zero Scenarios to Policy-Based Modeling

In response to this criticism, the IEA has adjusted its methodology, placing greater emphasis on policy-based modeling that reflects existing regulations rather than aspirational net-zero targets. This approach acknowledges the gap between announced climate commitments and actual implementation on the ground worldwide. By focusing on the Current Policies Scenario, the IEA provides market participants with a more pragmatic, data-driven forecast of energy demand.

OPEC and U.S. Energy Officials Welcome the New Stance

Oil-producing countries and industry leaders have welcomed the IEA’s revised outlook. Representatives from OPEC view these projections as validation of their stance that long-term oil demand will remain resilient. They have previously challenged calls to end fossil fuel investments, emphasizing the continuing importance of oil and gas. U.S. energy officials also appreciate the more balanced assessment, which supports continued investment in conventional energy alongside renewable development. Domestic oil and gas investments can yield monthly returns that contribute to financial success. This political reset influences how policymakers, companies, and investors assess the future energy mix and investment priorities.

Climate Goals Face Setback as Fossil Fuel Use Persists

The rising global oil demand projected by the IEA poses serious challenges to international climate objectives.

IEA Warns 1.5°C Target Is Out of Reach Under Current Trends

The IEA’s latest report delivers a sobering message: under current policies, the world is on track to exceed the critical 1.5°C global warming threshold. Carbon dioxide emissions from the energy sector reached a record 37 billion tons in 2022, surpassing pre-pandemic levels. The agency emphasizes that clean energy deployment alone will not suffice to meet the Paris Agreement’s goals without large-scale carbon removal technologies.

Projected Temperature Rise Exceeds 2.9°C by 2100

The Current Policies Scenario suggests a global temperature rise of approximately 2.9°C above pre-industrial levels by 2100. Even the less severe Stated Policies Scenario points to a 2.5°C increase. Both outcomes far exceed the Paris Agreement’s target, increasing the risk of extreme weather events, droughts, floods, and biodiversity loss. This temperature gap highlights the urgent need for stronger climate action.

Greenpeace and Climate Experts Call for Urgent Action

Environmental organizations like Greenpeace have strongly criticized ongoing fossil fuel projects, stating that every new development violates the 1.5°C limit. Climate experts dismiss industry reliance on carbon capture and forest offsets as insufficient and misleading. They call on governments to implement fast and fair plans to phase out fossil fuels and hold major polluters accountable, facilitating a just transition to renewable energy sources.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

LNG Expansion and EV Adoption Shape Future Energy Mix

Beyond oil, the energy landscape is being reshaped by significant developments in LNG supply and electric vehicle (EV) adoption.

This surge in electricity consumption will influence fuel demand and energy infrastructure planning, as well as the broader development of energy infrastructure to meet future energy needs.

Global LNG Supply to Grow 50% by 2030

Final investment decisions for new LNG projects surged in 2025, with about 300 billion cubic meters of new annual export capacity expected to come online by 2030. This represents a 50% increase in available LNG supply, expanding the global market from 560 billion cubic meters in 2024 to 880 billion cubic meters by 2035, and reaching 1,020 billion cubic meters by 2050. However, markets may face oversupply starting around 2027 due to robust production growth and slowing demand. The International Energy Agency forecasts a substantial surplus in the oil market for 2026 due to robust supply growth and slowing demand. The IEA forecasts global oil inventories to build by an average of 2.1 million barrels per day in 2026, with these inventory builds and price changes tracked on a month-to-month basis to better analyze market trends. We expect inventory builds will average 2.6 million barrels per day in 4Q25 and will remain elevated through 2026. Crude oil prices are expected to fall to an average of $62 per barrel in the fourth quarter of 2025.

EV Adoption Slows Outside China and EU

While electric vehicle adoption is rapidly advancing in China and Europe, other markets face challenges that slow EV growth. This uneven adoption contributes to sustained high oil demand globally, as transportation remains the largest consumer of oil despite structural changes. The rapid adoption of electric vehicles is displacing oil demand in the road transport sector, particularly in China and advanced economies. The slower pace of EV penetration in many regions helps explain why oil consumption forecasts continue to rise.

Data Centers and AI Drive Power Sector Demand

Data centers and artificial intelligence technologies have emerged as significant drivers of power demand. Research by Goldman Sachs anticipates a 50% increase in global power needs from data centers by 2027 and a 165% rise by 2030 compared to 2023. In the U.S., data centers consumed 183 terawatt-hours (TWh) in 2024, about 4% of total electricity use, with projections suggesting this could grow to 426 TWh by 2030. This surge in electricity consumption will influence fuel demand and energy infrastructure planning.

Refining Capacity May Need to Expand to Meet Fuel Needs

Asia and the Middle East are leading the growth in refining capacity, which increased by about 1 million barrels per day annually from 2022 to 2024. Expansion is expected to slow to an average of 620,000 barrels per day during 2025-2027. India exemplifies these trends, with liquid fuels consumption projected to rise 26% from 5.3 million barrels per day in 2023 to 6.6 million barrels per day by 2028. Despite global oil inventory builds averaging 1.9 million barrels per day each month from May through September, oil prices have remained stable, with Brent crude spot prices averaging $68 per barrel in September, unchanged from August.

Conclusion

The IEA’s latest projections reveal a world where global oil demand continues to climb, defying earlier predictions of a near-term peak. Under current policies, oil consumption is set to rise by 13% by 2050, reaching 113 million barrels per day. Natural gas demand follows a similar upward path, with significant growth expected through mid-century. Forecast global liquid fuels consumption increases by 1.1 million barrels per day in both forecast years. These new forecasts have profound implications for market participants, investors, and climate strategists alike.

Political forces have played a pivotal role in reshaping the IEA’s approach, shifting focus from net-zero scenarios to policy-based modeling. This change lends stronger support to ongoing fossil fuel investments while acknowledging the growth of renewables. Domestic Drilling and Operating embraces and applies the latest technologies to ensure optimal results for investors. The domestic oil and gas industry presents a diverse array of investment opportunities, attracting stakeholders looking to balance energy security with financial returns.

Despite these developments, the climate outlook remains dire. The world is on track to exceed the 1.5°C warming limit, with temperatures potentially rising by nearly 3°C by 2100. Climate experts urge immediate, decisive action rather than relying on carbon capture or offsets alone.

The energy landscape is also being transformed by LNG expansion, uneven EV adoption, and surging power demand from data centers and AI technologies. These factors contribute to a complex, evolving global energy scenario that challenges prior assumptions and requires recalibrated investment strategies and policy frameworks.

Balancing today’s energy needs with urgent climate imperatives presents a formidable challenge. As fossil fuels continue to dominate longer than expected, stakeholders must navigate a future where energy security, economic growth, and environmental sustainability are intricately intertwined.

Key Takeaways

- Global oil demand will surge 13% by 2050, reaching 113 million barrels per day, contradicting previous forecasts of peak demand this decade.

- Political pressure reshaped IEA methodology, shifting from climate-focused scenarios to policy-based modeling after criticism from oil producers and the Trump administration.

- Climate targets are now unattainable under current policies, with global temperatures projected to exceed 2.9°C by 2100, far beyond the Paris Agreement goal of 1.5°C.

- LNG supply will expand 50% by 2030, driven by Asian demand and new Russia-China pipelines, though markets may become oversupplied after 2027.

- Data centers and AI will drive massive power demand, potentially increasing electricity consumption by 165% by 2030, fundamentally altering energy requirements.

What is the IEA’s new projection for global oil demand by 2050?

The latest IEA forecast expects global oil demand to reach 113 million barrels per day by 2050, a 13% increase from 2024 levels.

How does this new projection differ from previous forecasts?

Unlike earlier predictions of a peak in oil demand this decade, the new forecast indicates steady growth over the next 25 years.

What factors are driving the projected increase in oil demand?

Emerging and developing economies, especially India, are driving demand growth through increased transportation, petrochemical use, and aviation fuel consumption.

What are the implications of this projection for climate goals?

The rising fossil fuel consumption makes achieving the Paris Agreement’s 1.5°C target virtually impossible, with projected temperature increases of around 2.9°C by 2100.

How is the energy landscape expected to change beyond oil demand?

Significant LNG supply expansion, slower EV adoption outside China and Europe, and surging power demand from data centers and AI technologies are reshaping the global energy mix.

These insights compel investors, policymakers, and climate strategists to prepare for a prolonged fossil fuel presence in the global energy mix and to urgently recalibrate energy transition timelines and climate adaptation plans.